In the annals of American history, the late 19th century stands as a time of unprecedented industrial growth, economic expansion, and the rise of influential figures whose business practices were both awe-inspiring and morally dubious.

These industrialists, often referred to as “robber barons,” played pivotal roles in shaping the nation’s landscape, but their cunning and ruthless strategies left indelible marks on the pages of history.

John D. Rockefeller: Master of Monopoly

John D. Rockefeller, a name synonymous with the Gilded Age and the American oil industry, crafted an empire that reached unparalleled heights through the relentless strategy of horizontal integration.

By aggressively acquiring and consolidating competing oil refineries, Rockefeller orchestrated the creation of Standard Oil, a behemoth that not only dominated the oil industry but also established an unprecedented monopoly, controlling over 90% of the oil refining business.

The Genesis of Standard Oil: Strategic Acquisitions and Consolidation

Rockefeller’s ascent began in the early days of the oil boom, where he recognized the potential for vast fortunes in the burgeoning industry.

Rather than engaging in traditional competition, Rockefeller implemented a strategy of horizontal integration.

This involved systematically acquiring and consolidating various oil refineries and businesses along the entire production and distribution chain.

Relentless Acquisition: The Cornerstone of Rockefeller’s Empire

Rockefeller’s strategy was marked by relentless acquisition. Through astute business acumen and shrewd negotiations, he absorbed competitors into the Standard Oil fold.

By eliminating competition, Rockefeller achieved economies of scale, streamlined operations, and exerted control over prices. Standard Oil’s dominance in refining gave it unprecedented influence over the entire oil industry.

Monopoly and Market Control: The Standard Oil Behemoth

As Standard Oil continued its acquisitions and consolidations, it morphed into an industrial giant.

By the late 19th century, the company held a stranglehold on the oil industry, controlling production, refining, transportation, and distribution.

This monopoly allowed Standard Oil to dictate prices, crush competition, and amass immense wealth.

The Trust Mechanism: Legitimizing Control

To consolidate and legitimize his control, Rockefeller utilized the trust mechanism.

Standard Oil Trust, formed in 1882, became the central entity overseeing the myriad subsidiaries and affiliates that comprised the empire.

This legal maneuvering allowed Rockefeller to maintain centralized control while ostensibly adhering to the legal frameworks of the time.

Legacy and Legal Confrontations: Breaking the Monopoly

While Rockefeller’s mastery of horizontal integration was an unparalleled success, it also sparked public outcry and legal challenges.

The sheer dominance of Standard Oil led to accusations of unfair business practices, anti-competitive behavior, and the stifling of free-market competition.

Ultimately, in 1911, the U.S. Supreme Court ruled to dismantle Standard Oil, citing violations of the Sherman Antitrust Act.

This marked a turning point in antitrust legislation and the regulation of monopolistic practices.

Rockefeller’s Legacy: Industrial Innovation and Ethical Dilemmas

John D. Rockefeller’s pursuit of dominance through horizontal integration left an indelible mark on American industry.

While Standard Oil exemplified unprecedented efficiency and industrial innovation, it also raised enduring questions about the ethics of monopolistic control.

Rockefeller’s legacy is one of both extraordinary business acumen and the need for regulatory measures to curb unchecked power in the pursuit of economic dominance.

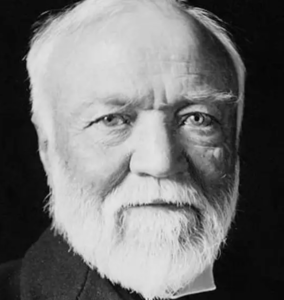

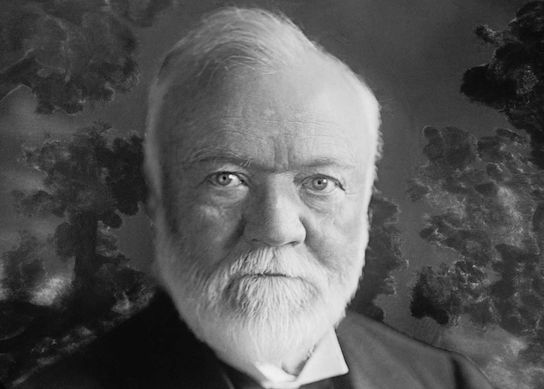

Andrew Carnegie: Steel, Strikes, and the Homestead Tragedy

Move: The Homestead Strike

Andrew Carnegie, a titan of the steel industry and a proponent of philanthropy, found his legacy tainted by the events of the Homestead Strike in 1892.

Orchestrated by his manager, Henry Clay Frick, the violent suppression of striking workers not only marked a dark turn in Carnegie’s ascent but also exposed the harsh realities of labor treatment in the relentless pursuit of profit.

Carnegie’s Steel Empire: Rise to Prominence

Andrew Carnegie’s journey in the steel industry was marked by innovation, vertical integration, and the creation of a vast industrial empire.

His company, Carnegie Steel Corporation, became a dominant force, and Carnegie himself accumulated immense wealth.

However, this ascent to prominence also brought to light the stark contrast between Carnegie’s public persona as a philanthropist and the harsh realities faced by his workers.

The Homestead Strike: Clash of Labor and Industry

In 1892, tensions between labor and management reached a boiling point at the Homestead Steel Works, a key facility within Carnegie’s steel empire.

Workers, facing wage cuts and deteriorating working conditions, initiated a strike to demand better treatment and fair wages.

Carnegie, while not directly involved in the day-to-day operations, entrusted his manager, Henry Clay Frick, with handling the labor dispute.

Frick’s Violent Suppression: Tarnishing Carnegie’s Legacy

Henry Clay Frick’s response to the striking workers was brutal and uncompromising.

In a move that shocked the nation, Frick hired Pinkerton agents to break the strike, resulting in a violent clash with the workers. The confrontation at Homestead led to bloodshed, injuries, and loss of life.

Carnegie’s legacy, built on the image of a benevolent industrialist, was tarnished as the public witnessed the brutality inflicted upon the very workers who had contributed to his vast wealth.

The Harsh Treatment of Labor: A Stain on Carnegie’s Philanthropic Image

The Homestead Strike laid bare the stark contrast between Carnegie’s public image as a philanthropist and the harsh treatment of his workers.

Despite later efforts to distance himself from the events at Homestead, Carnegie’s initial reluctance to intervene and his reliance on Frick to handle labor disputes raised questions about the sincerity of his commitment to workers’ rights.

Legacy and Reflection: The Dark Side of Industrial Philanthropy

The violent suppression of the Homestead Strike left an enduring mark on Carnegie’s legacy.

While his later philanthropic endeavors, such as funding libraries and educational institutions, sought to mitigate the stain of the Homestead events, the clash underscored the inherent tensions between labor and industry during the Gilded Age.

Carnegie’s legacy is now viewed through the lens of both industrial innovation and the ethical complexities of managing a vast industrial empire.

The Homestead Strike stands as a cautionary tale, revealing the human costs of industrial progress and the moral dilemmas faced by industrialists striving for economic success.

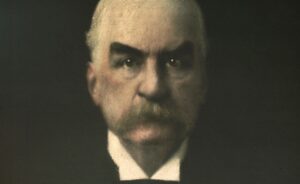

J.P. Morgan: The Wizard of Finance

In the tumultuous landscape of American finance during the early 20th century, John Pierpont Morgan, commonly known as J.P. Morgan, emerged as a pivotal figure during the Panic of 1907.

While credited with playing a crucial role in stabilizing the financial system during this crisis, Morgan’s influence and control over key financial institutions drew criticism from those who viewed it as emblematic of an unhealthy concentration of power.

The Panic of 1907: A Financial Maelstrom

The Panic of 1907, a severe financial crisis marked by bank runs, stock market crashes, and economic turmoil, tested the resilience of the American financial system.

As panic swept through the markets, trust in financial institutions eroded, leading to a cascade of failures.

Morgan’s Intervention: Stabilizing the Ship

In the midst of the panic, J.P. Morgan stepped into the fray with a bold and unprecedented move.

Utilizing his stature as a banking magnate, he orchestrated a series of interventions that injected much-needed liquidity into the system.

Morgan personally provided financial support, mobilized his banking associates, and even convinced other major financiers to pool their resources to stabilize the faltering banks.

Critics and Concentration of Power: A Dubious Triumph

While Morgan’s interventions were effective in quelling the panic and preventing a broader economic collapse, critics raised concerns about the concentration of power that his actions represented.

Morgan’s influence extended beyond the private sector, reaching into the corridors of government and policy-making.

Some argued that his outsized role in stabilizing the financial system only underscored the consolidation of power in the hands of a select few individuals.

The Morgan Legacy: Balancing Stability and Criticism

J.P. Morgan’s actions during the Panic of 1907 left an indelible mark on the history of American finance.

His efforts, while lauded for preventing a more severe crisis, contributed to an ongoing debate about the role of powerful individuals in shaping economic outcomes.

The concentration of financial influence in the hands of a select few, as exemplified by Morgan, prompted calls for regulatory reforms to ensure a more equitable and stable financial system.

In the legacy of J.P. Morgan, the events of the Panic of 1907 serve as a testament to the delicate balance between stability and the potential pitfalls of concentrated financial power.

While he averted immediate catastrophe, the episode raised enduring questions about the nature of influence in finance and the need for mechanisms to prevent the undue concentration of economic control.

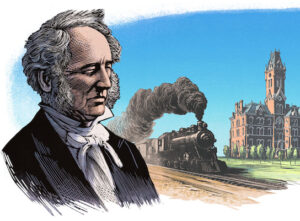

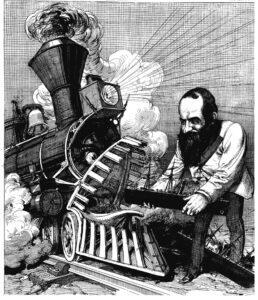

Cornelius Vanderbilt: Stock Watering and the Railroad Empire

In the annals of American industrial history, Cornelius Vanderbilt’s foray into the railroad industry was marked not only by ambitious expansion but also by a dubious financial practice known as “stock watering.”

This strategy, which involved inflating the value of a company’s stock by issuing more shares than its assets justified, became a powerful tool in Vanderbilt’s quest for capital and control over the burgeoning railroad empire.

Stock Watering: Financial Alchemy for Power

Vanderbilt’s rise to prominence in the railroad industry during the mid-19th century was characterized by shrewd financial maneuvering, and “stock watering” emerged as a key element in his toolkit.

This practice involved the deliberate inflation of the perceived value of a company’s stock by flooding the market with additional shares.

While this artificial inflation benefited Vanderbilt in raising capital, it came at the expense of unsuspecting smaller investors.

Inflating Value, Expanding Influence: The Vanderbilt Way

By issuing more shares than the tangible assets of his railroad companies justified, Vanderbilt created the illusion of increased company value.

This not only attracted more investors eager to partake in what seemed like a lucrative venture but also provided Vanderbilt with a substantial influx of capital.

This capital, often obtained from those who were unaware of the practice of stock watering, fueled Vanderbilt’s aggressive expansion plans and solidified his control over the railroad industry.

Capital at the Expense of Smaller Investors: A Dubious Triumph

While stock watering was a financially ingenious strategy for Vanderbilt, it came at a moral cost.

Smaller investors, drawn in by the allure of apparent prosperity, found themselves holding shares whose real value did not align with the inflated market prices.

As a result, they suffered financial losses when the true value of the railroad companies became apparent.

Vanderbilt’s triumph in the railroad industry, facilitated by stock watering, exemplified the ruthless nature of business during the Gilded Age.

His control over the railroad empire expanded as he amassed capital and secured dominance through questionable financial practices.

While these actions contributed to Vanderbilt’s legacy as one of the wealthiest individuals of his time, they also underscored the ethical compromises made in the pursuit of financial gain and power during this transformative period in American history.

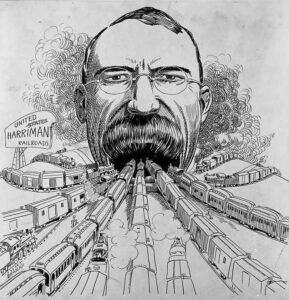

Jay Gould: Machinations in the Erie War

In the ruthless landscape of late 19th-century industrial America, Jay Gould emerged as a master manipulator in the railroad industry, showcasing unscrupulous tactics during the infamous Erie War.

His calculated and cunning maneuvers, including stock manipulation, bribery, and deceit, allowed him to gain control of the Erie Railroad.

Gould’s actions epitomized the cutthroat competition that defined the era, revealing a dark underbelly of corporate machinations and questionable ethics.

The Erie War: Unleashing Corporate Warfare

The Erie War, a bitter corporate struggle that unfolded in the 1860s, pitted Jay Gould against established interests in the railroad industry.

Gould, not one to shy away from controversy, embarked on a campaign marked by deceit and cunning strategies to wrest control of the Erie Railroad from its existing management.

Stock Manipulation: The Weapon of Choice

Gould’s primary weapon in the Erie War was stock manipulation. Using intricate financial maneuvers, he exploited weaknesses in the stock market to devalue Erie Railroad stock, making it an attractive target for acquisition.

Gould engaged in short-selling, spreading false rumors, and manipulating share prices, all designed to destabilize the market and create advantageous conditions for his takeover bid.

Bribery and Deceit: Unraveling the Fabric of Integrity

Gould’s tactics went beyond financial wizardry; he employed bribery and deceit to infiltrate the inner workings of the Erie Railroad.

Through a web of secret deals and backroom negotiations, Gould secured the loyalty of key stakeholders and board members.

His manipulation of corporate governance structures underscored the fragility of business ethics in the face of relentless ambition.

Gaining Control: The Triumph of Deception

Gould’s unscrupulous methods culminated in his successful takeover of the Erie Railroad.

Despite legal challenges and accusations of fraud, his manipulation of stock prices and strategic alliances allowed him to gain a controlling interest in the company.

The Erie War became a testament to Gould’s ruthlessness and highlighted the vulnerability of even well-established corporations to the tactics of a determined and cunning individual.

Cutthroat Competition of the Gilded Age: Gould’s Legacy

Jay Gould’s actions in the Erie War epitomized the cutthroat competition that characterized the Gilded Age.

In an era marked by rapid industrialization and economic expansion, the pursuit of wealth and power often overshadowed ethical considerations.

Gould’s legacy, tarnished by his unscrupulous tactics, serves as a stark reminder of the darker side of corporate warfare and the ethical compromises made in the name of success during a transformative period in American history.

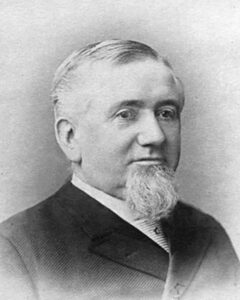

Henry Clay Frick: Partner in Profit, Architect of Tragedy

In the complex web of industrial history during the late 19th century, Henry Clay Frick, as Andrew Carnegie’s right-hand man, emerged as a central figure in the notorious events of the Homestead Strike of 1892.

His calculated decision to deploy Pinkerton agents against striking workers not only left an indelible mark on labor relations but also illuminated the ruthless methods employed to safeguard control and profitability in the steel industry.

Key Role in the Homestead Strike:

As the manager of Carnegie Steel’s operations, Frick was tasked with managing labor relations at the Homestead Steel Works, a crucial facility in the Carnegie steel empire.

In response to discontent over wage cuts and deteriorating working conditions, workers at the Homestead plant initiated a strike in 1892, seeking better terms and improved treatment.

Rather than engaging in dialogue or negotiation, Frick took an uncompromising stance.

Determined to crush the strike and maintain the upper hand in labor-management dynamics, he devised a plan that would become synonymous with brutality and corporate resistance.

Deployment of Pinkerton Agents:

Frick’s most infamous move was the decision to deploy Pinkerton agents, private security forces often employed by industrialists, to break the strike.

The use of Pinkertons was a deliberate strategy aimed at forcefully suppressing the workers’ resistance and reasserting control over the plant.

The arrival of the Pinkerton agents at the Homestead Steel Works on July 6, 1892, marked a turning point in the conflict.

Confrontations between the Pinkertons and striking workers escalated into a full-scale battle, resulting in violence, chaos, and loss of life on both sides.

The Homestead Strike became a symbol of the deeply entrenched conflicts between labor and management during this era.

Ruthless Methods for Control and Profitability:

Frick’s decision to deploy armed Pinkerton agents highlighted the lengths to which industrialists were willing to go to maintain control and protect profits.

The violent suppression of the Homestead Strike underscored a prevailing mindset that prioritized corporate interests over the welfare and rights of the workforce.

Frick’s actions, while condemned by many, were emblematic of a broader pattern in the robber baron era, where the ruthless pursuit of control and profitability often overshadowed concerns for the well-being and dignity of workers.

The Homestead Strike served as a stark reminder of the power dynamics inherent in industrial relations during a time of rapid industrialization and labor unrest.

In the annals of industrial history, Henry Clay Frick’s role in the Homestead Strike stands as a dark chapter, shedding light on the high human cost of maintaining dominance in the steel industry during a tumultuous period of economic transformation.

George Pullman: Paternalism and the Pullman Strike

George Pullman, celebrated for his innovative contributions to the design of luxurious railroad sleeping cars, adopted a paternalistic approach towards his workers.

Yet, this seemingly benevolent strategy took a dark turn as it unfolded in the establishment of the Pullman Company town.

The tragic climax of this narrative was the Pullman Strike of 1894, where Pullman’s commitment to control and the use of force became starkly evident.

Paternalism and the Company Town:

At the heart of Pullman’s strategy was the concept of paternalism, an approach where employers assumed a role of caretaker, providing for the needs of workers but also exerting tight control over their lives. In the late 19th century, Pullman established the town of Pullman, Illinois, a model company town designed to provide housing, amenities, and services for his workers.

On the surface, it appeared as a utopian vision of harmonious industrial living.

However, beneath the façade of benevolence lay a more sinister reality. Pullman exercised strict control over every aspect of the town, from housing to sanitation, and even the moral conduct of its residents.

Workers were subjected to rent deductions, and living conditions were tightly regulated.

Pullman’s paternalism, while offering apparent benefits, ultimately served to maintain a controlled and docile workforce, securing his dominance in the industry.

The Pullman Strike of 1894:

The unraveling of Pullman’s paternalistic vision reached its climax with the Pullman Strike of 1894.

Faced with economic hardship due to wage cuts, Pullman’s workers rebelled against the oppressive conditions.

Rather than engaging in dialogue or concessions, Pullman took a draconian stance.

Refusing negotiations, he relied on the might of his influence and the cooperation of government authorities to suppress the uprising.

The Use of Force and Oppression:

Pullman’s commitment to maintaining control became chillingly apparent as federal troops were deployed to quash the striking workers.

The use of force to suppress the strike was a stark reminder of the inherent flaws in Pullman’s paternalistic model. Workers were met with violence and coercion, revealing the harsh reality beneath the veneer of the company town.

The oppressive conditions and violent response to the strike brought national attention to Pullman’s practices, tarnishing his reputation and exposing the darker side of industrial paternalism.

The events surrounding the Pullman Strike underscored the vulnerability of workers in company towns and the lengths to which industrialists like Pullman were willing to go to protect their interests.

In the legacy of George Pullman, the paternalistic approach that crumbled under the weight of the Pullman Strike serves as a cautionary tale of the potential abuse of power and the consequences of prioritizing control over the well-being of the workforce.

Leland Stanford: Railroad Magnate and Political Player

Leland Stanford’s legacy as a robber baron is intricately woven into his strategic manipulation of the political landscape to amass wealth and expand the Central Pacific Railroad.

His keen understanding of the symbiotic relationship between business and politics enabled him to navigate the corridors of power, securing significant advantages that went beyond the competitive realm of the railroad industry.

Political Manipulation and Land Grants:

Stanford’s mastery lay in leveraging his political influence to extract favorable deals from the government.

During the mid-19th century, the federal government sought to encourage the construction of transcontinental railroads, viewing them as vital for economic expansion and westward settlement.

As a result, substantial land grants were offered to railroad companies to incentivize and support their ambitious projects.

Stanford, along with his associates in the Central Pacific Railroad, skillfully exploited this opportunity.

Through lobbying, political contributions, and strategic alliances, he ensured that the Central Pacific received generous land grants from the government.

These land grants were often in the form of vast stretches of undeveloped land adjacent to the railroad tracks, providing immense value and opportunities for future development.

Accumulation of Vast Land Holdings:

Stanford’s manipulation of the political system translated directly into the accumulation of vast land holdings for the Central Pacific Railroad.

These land grants served as both a source of revenue and a means of consolidating power. The acquired lands could be sold or leased, creating additional streams of income for the railroad company.

Moreover, the control of extensive lands conferred strategic advantages. It allowed the Central Pacific to dictate terms in terms of future development, influencing the growth of towns and cities along its rail lines.

Stanford, in his role as a railroad magnate, wielded significant influence over local economies, shaping the destiny of regions that fell under the shadow of the expanding railroad empire.

Impact on the Railroad Empire:

The land grants secured by Stanford played a pivotal role in the expansion and consolidation of the Central Pacific Railroad.

The acquired lands provided the necessary resources for the construction and maintenance of railroads, ensuring the continued growth and dominance of the company in the western United States.

Furthermore, the strategic positioning of these lands allowed Stanford to control key transportation routes, influencing trade and commerce across the newly connected regions.

The manipulation of the political system, therefore, not only contributed to the financial success of the Central Pacific but also solidified Stanford’s position as a key architect of the emerging economic order in the American West.

In the annals of American industrial history, Leland Stanford’s adeptness in political maneuvering, resulting in the accumulation of extensive land grants, exemplifies the quintessential robber baron mentality.

His actions reveal a pattern of exploiting the intersection of business and politics for personal gain, leaving an enduring mark on the landscape of 19th-century America.

As we look back at these titans of industry, their cunning and often morally questionable strategies shaped the course of American history.

The legacy of the robber barons is one of both awe-inspiring economic growth and the shadows cast by ruthless pursuits of wealth and power.

No responses yet